When trading binary options, it is important to choose your online broker carefully. Since all transactions must go through their intermediaries, this choice must be taken conscientiously in order to avoid the risks of various scams and scams in the web world.

Indeed, in the field of online trading, scams are numerous and require increased vigilance on the part of the trader. The risks are numerous, particularly for the security of the funds paid in, but also the guarantee of being able to withdraw the gains. It is in this perspective that the use of a broker regulated by CySec and/or the AMF is essential.

Each online brokerage offers different tools and functionalities to help investors registered on their platform. Indeed, in addition to the trainings presented by the brokers, they can also set up different tips to help investors make real profits. These include tips for chart analysis, indicators and curves certified by Reuters, and a customer service department that will respond to customers fairly quickly.

But each of these brokers is different in terms of the services, rate of return and number of underlying assets they offer. To help you through the difficult dilemma of choosing a trusted broker, here are some criteria for the tools available from these online brokers.

Choose the asset to trade

Binary options platforms provide the trader with the tools to invest in various assets. Also, it is necessary to choosing the right asset on which to invest because the more volatile the assets, the greater the profits. Conversely, if you want to make slightly less risky trades, you can opt for more or less stable assets or types of binary options with a fairly low return. Either way, all trader profiles will find their account, as there are many assets to choose from

Binary options platforms provide the trader with the tools to invest in various assets. Also, it is necessary to choosing the right asset on which to invest because the more volatile the assets, the greater the profits. Conversely, if you want to make slightly less risky trades, you can opt for more or less stable assets or types of binary options with a fairly low return. Either way, all trader profiles will find their account, as there are many assets to choose from

The expiration of the binary option

In binary options, expiry or expiration is the moment when the trade will end. It is therefore very important to choose the right time because that is when the investor will know whether he has made or lost money. Moreover, brokers offer different maturities, ranging from 60 seconds to the weekend or even the current month. It should also be taken into account that the shorter the term, the higher the risks and profits.

In binary options, expiry or expiration is the moment when the trade will end. It is therefore very important to choose the right time because that is when the investor will know whether he has made or lost money. Moreover, brokers offer different maturities, ranging from 60 seconds to the weekend or even the current month. It should also be taken into account that the shorter the term, the higher the risks and profits.

Roll-over functionality

Le Roll-over est un outil mis en place par certaines plateformes qui permet aux traders de soit extend a binary option contract at the next expiry provided on the broker or to close the contract with its expiry. On some platforms, these two features are quite distinct. So to extend a contract, you will have to issue a Roll-Forward or Extend Option. You will be able to use it in case the trend of the asset you are trading has not yet reached the required level and thus take advantage of this second chance to maximize your gains.

Le Roll-over est un outil mis en place par certaines plateformes qui permet aux traders de soit extend a binary option contract at the next expiry provided on the broker or to close the contract with its expiry. On some platforms, these two features are quite distinct. So to extend a contract, you will have to issue a Roll-Forward or Extend Option. You will be able to use it in case the trend of the asset you are trading has not yet reached the required level and thus take advantage of this second chance to maximize your gains.

The option Roll-Over is quite the opposite, since if during the course of the contract, you judge that it is time to end the trade, you will just call on theOption Close. Cases that arise may be either a price increase that does not follow your expectations or to anticipate a possible abrupt change in the movement.

These tools are not usually offered systematically for all binary options, especially for the Extend option. Most platforms will offer it 15 min before the end of the term and you can choose to take this chance or not, especially since there will be a fee for doing so. Of course, the 60 second options are not concerned since it would be totally up to their operating principles.

The Take Profit tool

Cet outil sert à peu près d’insurancebecause it guarantees traders that they can collect the winnings no matter what happens. It works in much the same way as the Close option, as it gives the trader the opportunity to close a contract before the end of the contract term and recover some or all of the option‘s gains. Thus, this tool makes it possible to secure one’s gains regardless of the final direction of the option.

Cet outil sert à peu près d’insurancebecause it guarantees traders that they can collect the winnings no matter what happens. It works in much the same way as the Close option, as it gives the trader the opportunity to close a contract before the end of the contract term and recover some or all of the option‘s gains. Thus, this tool makes it possible to secure one’s gains regardless of the final direction of the option.

Please note that in order to recover the totality of the earnings, you will have to subscribe to a premium in exchange. Of course, like the other tools, this feature is not mandatory and is not systematically proposed by the broker. It will depend on the type of option and will also appear 15 minutes before expiration.

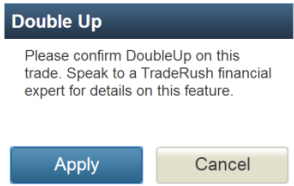

The Double-Up

As the name implies, Double-up allows the trader to double his profits. Although it is a recently implemented tool, many platforms have integrated it. In particular, it allows the trader to make the same investment (replicate the trade) before the expiry time arrives. So if your speculation was the right forecast (the exact term is “the right forecast”), you can be sure that the trade will be completed before the expiry time in-the-money “), you double your profits.

As the name implies, Double-up allows the trader to double his profits. Although it is a recently implemented tool, many platforms have integrated it. In particular, it allows the trader to make the same investment (replicate the trade) before the expiry time arrives. So if your speculation was the right forecast (the exact term is “the right forecast”), you can be sure that the trade will be completed before the expiry time in-the-money “), you double your profits.

Some platforms will offer it to you at least 5 minutes before it expires at no charge. However, you should also bear in mind that the risk of the position ending “in the end” is not as high as the risk of the position ending “in the end” out-of-the-money ” is always possible, in which case you will lose twice the amount invested.

The Builder or Customization Option

L’Option Builder donne la liberté au trader de create his own option. Of course, it will be aimed at the more experienced trader with a well-established trading strategy, as this function requires extensive analysis and a deeper knowledge of the market. It is probably the most recent of the tools integrated into binary options brokers. The most strategic investors will therefore find it a most profitable opportunity, since the contract will be customized according to their expectations.

L’Option Builder donne la liberté au trader de create his own option. Of course, it will be aimed at the more experienced trader with a well-established trading strategy, as this function requires extensive analysis and a deeper knowledge of the market. It is probably the most recent of the tools integrated into binary options brokers. The most strategic investors will therefore find it a most profitable opportunity, since the contract will be customized according to their expectations.

The trader will therefore be able to choose all the parameters that go into his trade: direction of the desired change, option expiration time, amount of possible gains, risks incurred, rate of return and return on loss, and other security parameters.