Technical analyses are an indispensable element in the field of stock market investment. Particularly in binary options trading, position openings must always be made taking into account market movements to have a chance of winning. In order to facilitate these analyses, brokers provide traders with various graphical tools. Japanese candlesticks are among the most widely used. Here’s how to use this technique in the binary market:

The interpretation of the Japanese Candlesticks

The use of Japanese Candlesticks is definitely not new. Since the 1600s, the Japanese have used this graphic tool to analyze rice prices. Because of its effectiveness and ease of use, the practice was then popularized by financial expert Steve Nisson.

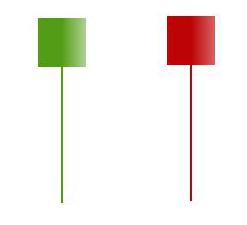

The basic “candle

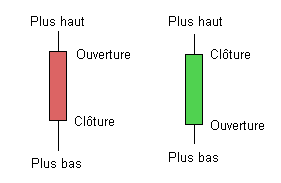

Japanese Candlesticks are also called Japanese Candlesticks because of their shapes. The appearance of the design is, in fact, like a candle, a kind of 2D tube with a wick coming out of each end. The top end represents the opening course and the bottom end represents the closing course. The body of the candle represents the interval between these two values. Generally, Japanese candlesticks use one unit per day. Thus, the highest price reached during the day is represented by the upper end, while the lowest price reached is represented by the lower end of the wick. These extreme changes of the day are called the high and low shadows. In principle, a lighter colour is used for the candle that shows a rise and a darker colour for the one that represents a fall. In order to plot Japanese Candlesticks, the trader must therefore have these price values, which are usually available in the history tab of the analysis software. Decision making must then be made based on the trends plotted.

The basic “candle”

The figures to be interpreted:

When interpreting Japanese Candlesticks, reference should be made to the appearance of each candle. There are a few specific figures to know, making it easier to make predictions.

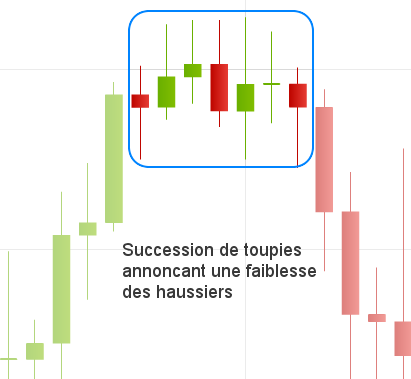

- The spinning top: When a candle is small compared to the length of its wick, it is called a spinning top. This means that the interval between the bullish and bearish points is very small. There is thus some hesitation as to the balance of the asset price. Positions should be taken with caution.

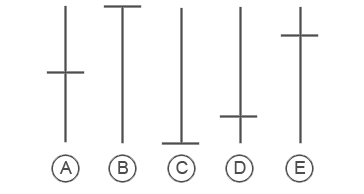

- The doji: In the case of a doji, there is no difference between the opening and closing prices. The candle then appears as a simple line. When the line is placed just in the middle of the wick length, it means that there was a variation in the price during the day, but that no change was shown at the close. Usually, this type of pattern marks either a reversal of direction or just a small pause in an already marked trend. There are also other forms of doji, such as tombal doji and dragon doji, which represent a sharp drop or rise during the day, but with a cancellation at closing. In this case, market reactions are still marked by indecision. It should be noted, however, that when dojis follow one another, there may be a significant change for the next session.

The 5 types of doji that you can find

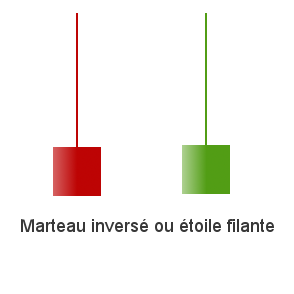

- The shooting star or inverted hammer: The shooting star is like the spinning top, with a small candle, but located in an upward trend. The high wick means that the bullish trend is stopped temporarily and that a rebound will surely occur the next day.

- The hammer: The hammer is like the shooting star but, conversely, the candle is in a downward trend, with a low wick. The interpretation is the opposite of the shooting star, but always with a probable rebound the next day.

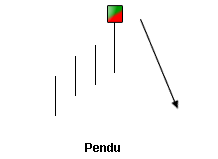

- The Hanged Man: The hanging man, on the other hand, is a fusion of the shooting star and the hammer. The spinning top is characterized, indeed, by a low bit but is placed in an upward tendency. This figure can herald the end of the upward trend, but only if the trend shown by the next day’s candle is bearish.

There are still other Japanese candle figures, which are born from different combinations. But in any case, it must be kept in mind that the predictions offered by the candlesticks require events the next day before being confirmed. Hence the need for tracing.

The interest of using this type of graph

In stock market investments, and particularly in binary options, it is essential to rely on technical analysis before making a decision. Many traders, however, do not have enough time to conduct in-depth studies, but instead of opening positions blindly, it is more interesting to use a reliable and fast tool. Japanese Candlestick Makers offer an effective technical analysis, which can be easily interpreted at a glance. Especially in binary options, which are played in short time intervals, this type of graph provides essential information quickly.

The price developments are presented simply via the aspects of the candles and it is easy to spot significant events in a short period of time. In contrast to line charts, Japanese Candlestick charts above all save time in terms of market analysis. For even more accuracy in forecasting, the trader can then merge the use of the chart with the use of indicators such as RSI or MACD. This will make technical analysis even more reliable.